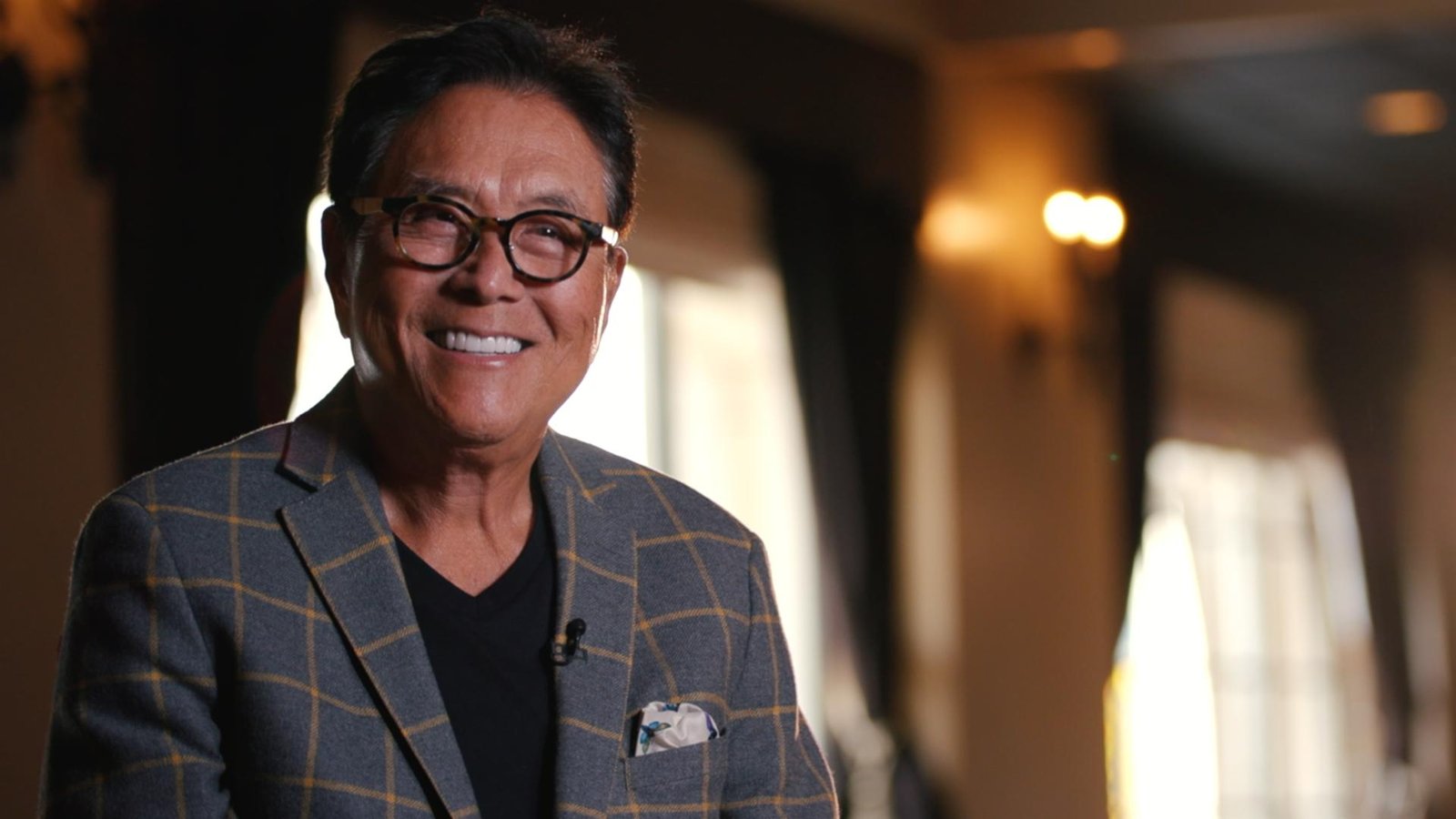

Robert Kiyosaki, the bestselling author of Rich Dad, Poor Dad, has long championed the importance of financial education and building wealth.

Among his key tenets is the idea that earning passive income—money that comes in without active work—is the way to financial freedom. Here are Kiyosaki’s six best passive income ideas.

Real Estate Investments

Kiyosaki encourages investing in real estate. Unlike a salaried job where you work for money, in real estate, your money works for you. Buying properties and renting them out can provide a steady stream of income.

Over time, as property values increase and your mortgage decreases, you stand to gain both from rental income and property appreciation. Kiyosaki often emphasizes the importance of leveraging other people’s money (like loans) to fund such investments, so you don’t have to start with huge capital.

Dividend Stocks

Stocks that pay dividends are another avenue for passive income. When you invest in a company’s stock that offers dividends, you’re essentially buying a share of that company’s profits.

As the company makes money, it shares a portion of those profits with stockholders in the form of dividends. If you invest wisely in stable, dividend-paying stocks, you can accumulate shares over time and enjoy a regular dividend payout, which can be either reinvested or used as income.

“If you purchase a stock that pays a dividend, then, as long as you own that stock, it will generate money for you in the form of a dividend,” said Kiyosaki in his column. “That is how you cash flow through the stock market.”

Royalties from Intellectual Property

If you’re an artist, writer, musician, or inventor, this is particularly relevant. Anytime someone uses your creation, be it a book, song, patent, or any other form of intellectual property, you earn a royalty.

For instance, every time a book you’ve written is sold or a song you’ve composed is streamed, you get a percentage of that sale. Though it requires initial effort to create, the subsequent income can be passive for years or even decades.

Kiyosaki created a financial literacy game called Cashflow. He spoke about how he earns passive income from this game. “So, when I create that cash flow game, it’s intellectual property, it’s patented, and it’s in 50 different languages,” said Kiyosaki during a speaking engagement. Every quarter, they send me a check. I put zero investment into it.

When I write a book, I think I make about $600,000 a month just from royalties coming off this book because I sell the book to a book publishing company, and they send me a check.”

Create a business that operates without you.

This might sound daunting, but Kiyosaki’s point is that instead of working in your business, work on your business.

This means setting up systems, hiring the right people, and automating processes so that the business can run and make money even if you’re not actively involved. This might require initial involvement, but the goal is to reach a point where the business thrives without your day-to-day oversight.

Earn interest from lending money.

Instead of just saving money in a bank, consider lending it out to earn interest. This can be done through platforms that offer peer-to-peer lending, allowing you to lend your money to individuals or small businesses in exchange for interest payments.

It’s a way to make your money work for you, but it’s essential to be mindful of the associated risks and choose platforms and lending opportunities wisely.

Annuities

An annuity is an agreement where a person pays an insurance company and, in return, receives periodic payments in the future. They can offer a consistent income during retirement, but they carry certain risks.

Various annuity types, such as immediate, deferred, and variable, serve as passive income sources. With immediate annuities, individuals start getting payouts right after buying them.

Deferred annuities start payments later, often during retirement. On the other hand, variable annuities can yield greater returns but come with higher risks, as the payouts depend on the success of their underlying assets.

Earning Passive Income

Kiyosaki advises building multiple streams of passive income for financial freedom. Through his passive income ideas, you can generate revenue even without active participation.

These strategies, when implemented wisely, can pave the way for sustained wealth and more financial independence, aligning with his core philosophy of letting money work for you.

Source: www.gobankingrates.com